Collecting debt is a difficult task for anyone that extends credit or lenders everywhere. Borrowers are often unable to pay on time for reasons ranging from job losses, illnesses, divorce, and other unforeseen circumstances.

This often causes collectors to be a tad too aggressive in their collection efforts, which can result in preventable mistakes. For instance, a collection agency might find itself pursuing a debt that has already been collected or that didn’t exist in the first place.

Debt collection software solves these issues as well as many others. With collection software in place, you get to keep better, more accurate records, so you don’t start chasing debts that have already been paid. You’ll also improve communication between the agency and your customers, which in turn breeds loyalty and encourages repeat business.

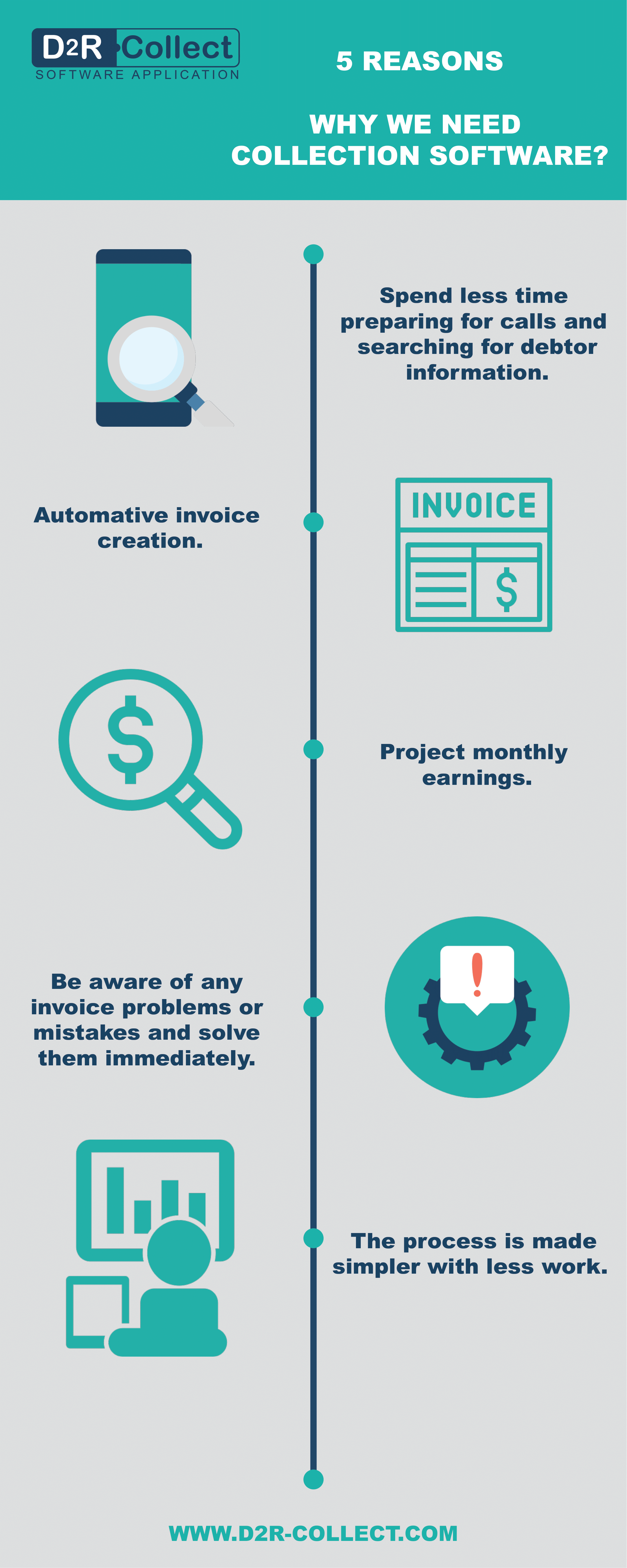

5 Other Advantages of Debt Collection Software

Aside from eliminating common collection mistakes and improving customer communication, debt collection software can also benefit your collection efforts in the following ways:

1. Stop wasting time searching for information and start discussing payments

Debt collection software stores all your data in one central location. Therefore, all the information you need is available in the click of a button. This leads to less time being spent preparing for calls and more time spent on the actual call.

2. Automate the creation of accurate invoices and attached PDFs to emails

This level of automation gives your customers plenty of time to study their invoices and process payments on time. The result?Increased early payments and more time to resolve any arising disputes.

3. Improvements in financial transparency which leads to faster decision making

Whether it’s expected payments, payments due, or those overdue, you always know what’s going on with regards to collections. This both improves your borrowing position as well as allows you to maximize unused credit lines.

4. Uncover and resolve potential invoice mistakes with alerts

At least 49% of collection disputes arise from missing or incorrect purchase order information on invoices. Collection software systems send alerts in the case of such mistakes, allowing you to resolve any errors on the spot.

5. The collection process becomes simpler, faster, and more efficient

Collection software allows you to automatically assign tasks for employees, accept payments online, save time with automated email, and even automate communication with customers.

Ready to Get Started?

Choose the D2R Collect debt recovery solution to get paid faster while reducing bad debt write-off. Contact us today to learn more about our debt collection software!

Sharing is caring!