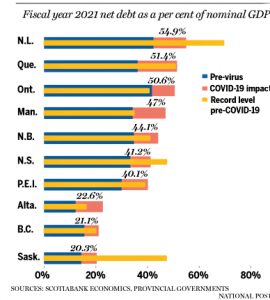

The coronavirus (COVID-19) pandemic has created multiple new challenges for the debt collection industry.The graph below shows the expected level for most provinces for the fiscal year 2021.

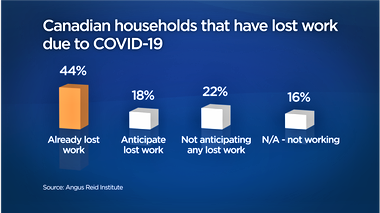

A recent survey, for instance, indicates that almost two thirds (64%) of credit customers anticipate (or have had) a wage loss. In the US, the majority of those affected are losing $500+ a month. At least 27% say they’re losing more than $1,000 in wages monthly.

Some of these people have actually lost their jobs altogether. In the US, for instance, 36 million people had filed for unemployment benefits by May 14. Meanwhile, according to The Guardian, unemployment in the UK is now at 9% from 4% early in the year.

Moreover, it’s not just about the income and job losses, the new social distancing rules, curfews, and lockdowns have also seriously hindered debt collection efforts. Employees can’t come into work, creditors who’d like to pay in person can’t do so, and even worse,

in some instances, agencies are being forced to trim their workforce. Collection agencies can address these new challenges in two steps:

Step #1: It’s Time for Fresh, Enhanced Customer-Friendly Solutions

Collection departments and agencies must find new and more supportive ways to “deal with” debtors. If you’re to survive this crisis and position your organization for long-term growth, you need a different approach; you need to show that you care about the well-being of your customers.

To this end, debt collection agencies must;

● Respect, listen to and treat customers with empathy

● Assist customers to prevent delinquency in the first place

● Provide options in regards to methods and timing of payments

● Provide education on delinquency and its impact on an individual’s life

Collectors that can deliver on these areas are much more likely to get paid. In situations where the debtor owes multiple creditors, you’re also more likely to be paid first.

Step #2: Embrace Debt Collection Tech Solutions to Boost Efficiency

Many organizations already use technology to solve various collection challenges. In light of the COVID-19 situation, the rest must follow suit. We recommend the following:

1. Effectively go virtual

Meetings, for instance, can take place virtually. You don’t have to meet in person. If you need to meet a customer to discuss payment options, do it via video chat. It’s not only more efficient for both of you but also cost-saving for the customer.

2. Manage employees and delegate tasks online

Remote work reduces the time and money spent on commute, meaning that employees can spend more time working for your organization. Better still, studies show that people who work from home are a lot more productive.

3. Improve collection security and privacy

Debt collectors, by the very nature of their jobs, need to collect and store customer information, either themselves or through third parties. You must viciously guard the collected data from misuse, interference, loss, or unauthorized access. It goes a long way in boosting brand reputation and customer loyalty.

4. Migrate all data online

First of all, debtors feel more comfortable to make repayments when they can access their information online via secure methods. Secondly, today’s consumers already spend a lot of time online. Therefore, taking your organization’s operations online means bringing services closer to your customers.

5. Find solutions to payment problems

An increasingly popular solution here is online (web/cloud-based) debt collection software systems with innovative recovery technology. These collection software systems increase the collection rate, encourage early repayment, decrease collection time, and boost customer experience.

It’s About Both Short and Long-Term Outcomes

The economic impacts of COVID-19 will likely be felt for an extended period of time. The measures discussed above will help you and your organization make more collections in the short and medium-term as well as position your team for long-term success.

Sharing is caring!